Easy Approval Process For Your Purchase Invoices

🤔 Spending hours trying to figure out which supplier invoices need paying?

🤔 Not sure what has already been approved for payment by an authorised person in your organisation?

🤔 It’s never clear who approved an invoice for payment and who you should direct your queries to?

🤔 Jumping between different spreadsheets and software and comparing the lists to make sure you don’t miss anything?

🤔 It happens that things get paid twice?

This is so frustrating!

We can feel your pain.

Who wouldn’t go crazy doing this?!

And if the payment runs in your organisation are frequent, going through this all the time is so unproductive.

You’d rather spend time doing thing once but right and prefer if your employees had clear and easy to follow procedures?

Stay with us because we have an awesome solution that:

➡️ is super easy to implement and use

➡️ provides a strong internal control which is needed in big organisations

➡️ helps you control your expenditure and make sure your company is run properly

➡️ keeps everything in one place

➡️ provides clarity

Easy Approval Process For Your Purchase Invoices within Xero software

Xero accounting software lets you categorise your supplier invoices into different groups.

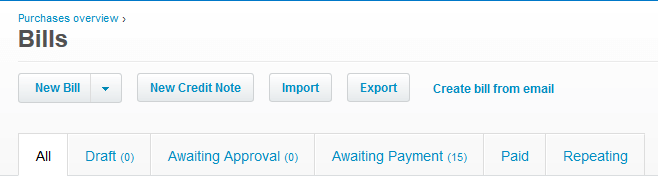

Let’s look at the photo below. The categories are all, draft, awaiting approval, awaiting payment, paid, repeating.

For your approval workflow you will be mostly interested in draft, awaiting approval and awaiting payment.

Draft:

You can designate one team member in your company to be responsible for preparing all drafts for supplier invoices that your company receives. A draft status of a bill in Xero means that this bill isn’t posted to your accounts, so your reporting isn’t affected at this stage. You can forward your bills to Xero and someone can pick them up from within the software and create draft bills.

Awaiting Approval:

You can then have another person (or the same) going through the drafts and submitting them for approval. At this stage your bills still aren’t reflected in your accounts. Submitting bills for approval requires just one click and you can submit a bunch of drafts at the same time.

Adding an extra step when drafts need to be approved means there’s an extra level of review in the process. This lets you control the expenses in your company more effectively and spot any mistakes which can be easily corrected, like for example wrong VAT rates.

Any problems with invoices, like missing payment details, wrong charges etc., can be still reviewed at this stage and if a bill isn’t ready for payment, you just leave it under this tab. This completely removes a risk of paying something that shouldn’t be paid either at all or not at this stage yet. It’s easier than paying something by accident and then trying to recover your money back, isn’t it?

Awaiting Payment:

From within awaiting approval tab, you can easily approve your invoices for payments. Once your bills are reviewed and signed off by an authorised person, they get automatically moved to the awaiting payment tab. At this stage your bills get posted to your accounts.

Let’s say you make payment runs every week. This tab makes it really easy to see what needs paying as you only process bills that are here and you’re not bothered with anything in different tabs. When you pay your bills, you can either mark them as paid straight away, which will remove them from this tab, or leave them for when you will do your bank reconciliation and match them then. This will also remove them from this tab. It’s just two different ways of doing this.

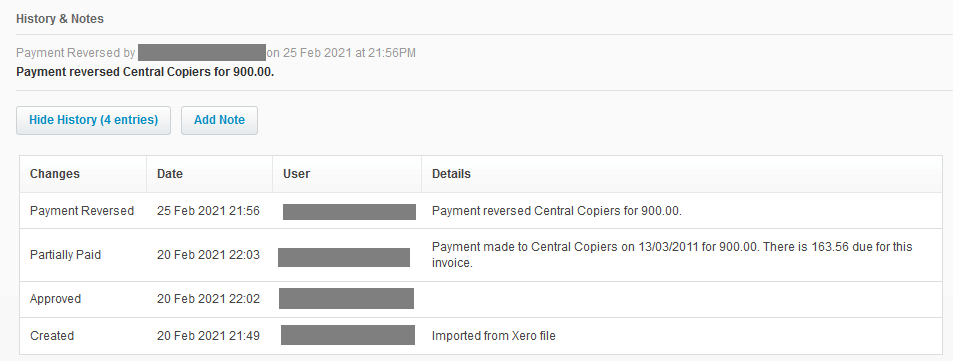

How do I know who’s done what with a bill?

At every stage within your approval process you can easily see who created a bill, who approved it and who paid it. If there are a few people who are responsible for bills in your organisation, this is really useful as you always know who to refer to with any queries.

This also introduces great and strong internal controls for your processes. The bigger your company, the more transparent and easy to follow your processes should be.

This is the audit history that you can find under each bill in Xero:

Is this solution only for big companies?

No. If you run a small self-employed business, you can still use the same process. This will bring clarity and help you control your payments making sure you pay bills correctly.

If you have an assistant, you can use it together. Your assistant can be creating the drafts and submitting bills for payments and you will be the one approving them. Then you can either make the payments or let your assistant be responsible for this. This way your assistant pays only what has been previously approved by you.

Is this process easy to implement?

Implementing the approval process described above is super easy and can be done straight away. First of course it needs to be communicated with relevant people. However, in terms of technicalities setting it up takes no time at all.

Want to start straight away? Log into your Xero account!

You’re not using Xero yet but you’re interested? Our Xero accountants from Oxford can help. Contact our Oxford bookkeeping office.

Your Accountant in Oxford

Oxford Office

Joanna Bookkeeping

The Wheelhouse Angel Court

First Floor, Angel Court

81 St Clements St

Oxford

OX4 1AW

Connect

joanna@joannabookkeeping.co.uk

01865 591952